Annual Corporate Fiscal Year Cicle

Every publicly-traded company’s fiscal year creates an annualized cycle of obligations related to financial reporting, regulatory disclosures, shareholder communications, corporate governance, board assessment and sustainability. The annual shareholders meeting and quarterly financial reports are key points on this annual corporate compass. Morrow Sodali’s services are organized to work in coordination with the annual corporate cycle and provide timely assistance to clients dealing with their sequential obligations. With sustainability, environmental and social policies joining corporate governance and financial performance as fundamental shareholder concerns, there is increased pressure on companies to develop an integrated approach to these issues.

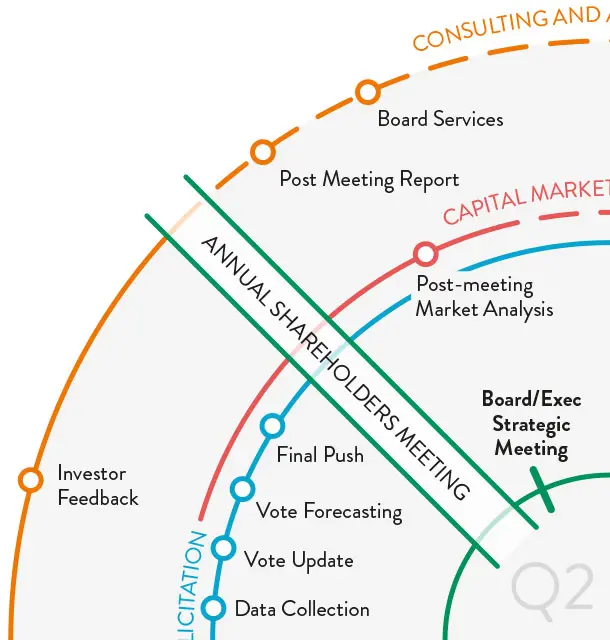

It is clear that managing relations with shareholders and the capital markets is a year-round job best done in a coordinated manner in alignment with a company’s fiscal year. The accompanying diagram shows how Morrow Sodali’s core service categories – strategic corporate governance consulting, capital markets intelligence, proxy solicitation and transactional services – align with and support clients’ annual corporate cycle.

To achieve this goal, Morrow Sodali offers a comprehensive set of services that help clients:

- identify who owns their shares

- analyze the implications of that ownership

- monitor ownership changes and market activity

- collect and analyze data relating to shareholder policies and voting decisions

- benchmark ESG, compensation and board policies,

- assess risks and vulnerability to activism

- prepare predictive vote projections,

- fine-tune annual meeting proposals to strengthen shareholder support

- organize engagement campaigns and governance road shows

- plan and conduct proxy solicitation and vote tabulation

- review strategic decisions and lessons learned

- provide data and insights for governance benchmarking and board evaluation,

- prepare for ad hoc initiatives such as mergers and other corporate actions

- deal effectively with special situations such as takeovers and proxy contests

- establish a relationship of trust with key owners and investors